Jul 07, 2022

COMMENT is an informative newsletter targeted to the unique niche that CLU advisors occupy in the financial services industry, with a focus on risk management, wealth creation and preservation, estate planning, and wealth transfer.

Feb 22, 2021

On Friday, February 19, 2021, Prime Minister Justin Trudeau announced an extension to: - Canada Recovery Benefit - Canada Recovery Caregiving Benefit - Canada Recovery Sickness Benefit - Employment Insurance

Feb 12, 2021

Great news for some ineligible self-employed Canadians who received the Canada Emergency Response Benefit (CERB)

Dec 29, 2020

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400.

Dec 07, 2020

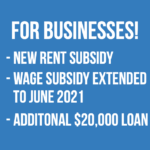

Finance Minister Chrystia Freeland recently provided the government's fall economic update. It included information on the government's strategy for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We've summarized the highlights for you: • Corporate Tax Changes, including extensions to subsidy programs. • Personal Tax Changes, including additional Canada Child Benefit Plan payments and a new "Work from home" tax credit. • Indirect Tax Changes, including the proposal to charge GST/HST on services provided via digital platforms, as well as the temporary removal of GST/HST on face masks and shields. For business owners, as of December 4th, the CEBA loan has been expanded by an additional $20,000.

Nov 23, 2020

The new Canada Emergency Rent Subsidy is open for applications today! Unlike the previous program, this subsidy will provide payments directly to qualifying renters and property owners, without requiring the participation of landlords. CERS covers up to 65% of rent for businesses, charities and non-profits impacted by COVID-19. An additional 25% Lockdown Support is available during a public health lockdown order.

Oct 13, 2020

The Canada Recovery Benefit (CRB) is now open for applications. If you are eligible for the CRB, you can receive $1,000 ($900 after taxes withheld) for a 2-week period. If your situation continues past 2 weeks, you will need to apply again. You may apply up to a total of 13 eligibility periods (26 weeks) between September 27, 2020 and September 25, 2021.

Oct 09, 2020

Great news for businesses! The new Canada Emergency Rent Subsidy will be available directly to business owners who need rent relief. The Wage Subsidy has been extended to June 2021. And the CEBA has been expanded to provide up to $20,000 interest-free loan.

Oct 05, 2020

Starting October 5, 2020, the Government of Canada will be accepting online applications for the Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

Sep 24, 2020

On September 23rd, in a speech delivered by Governor General Julie Payette, Prime Minister Justin Trudeau outlined the Federal government's priorities.